Watches Gaining the Most Value in 2026

These 20 watches are currently trending upward in market value, making them the most actively appreciating timepieces in our database. Whether driven by scarcity, collector hype, or recent discontinuation, each has shown positive momentum in 2026.

#1. The Tudor Submariner is trending upward with a market average of $12,000 against a ~$12,000 (market value) retail — a 1311.8% premium. This dive watch carries a flip potential score of 8/10.

#2. The Tudor Submariner is trending upward with a market average of $7,000 against a ~$7,000 (market value) retail — a 366.7% premium. This dive watch carries a flip potential score of 8/10.

#3. The Rolex Submariner Date is trending upward with a market average of $21,000 against a ~$21,000 (market value) retail — a 119.9% premium. This dive watch carries a flip potential score of 9/10.

#4. The Rolex Cosmograph Daytona is trending upward with a market average of $31,000 against a ~$31,000 (market value) retail — a 113.1% premium. This chronograph carries a flip potential score of 9/10.

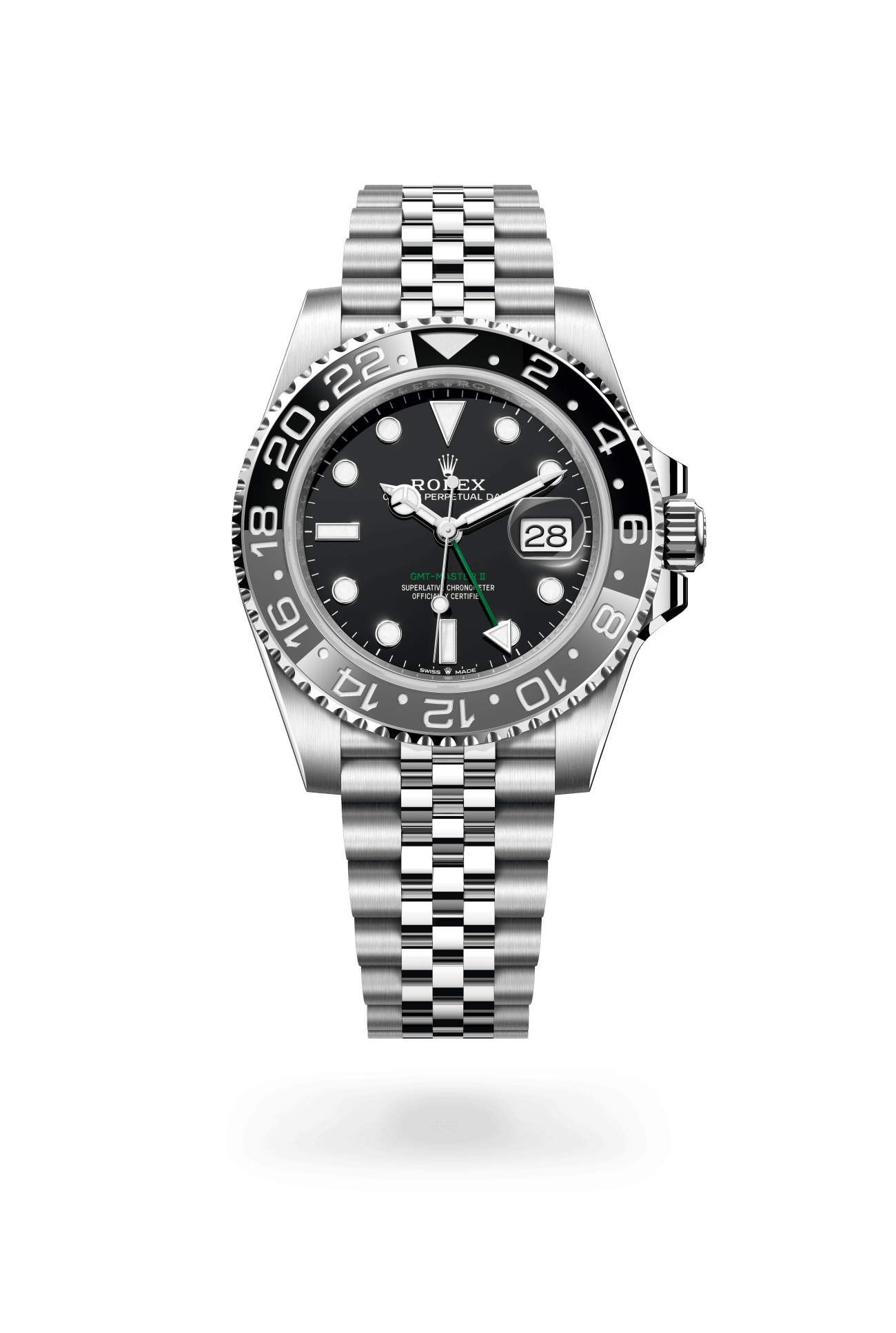

#5. The Rolex GMT-Master II is trending upward with a market average of $21,500 against a ~$21,500 (market value) retail — a 102.8% premium. This gmt / travel watch carries a flip potential score of 9/10.

#6. The Omega Speedmaster Moonwatch Anniversary Series Silver Snoopy Award is trending upward with a market average of $22,000 against a $11,100 retail — a 98.2% premium. This chronograph carries a flip potential score of 7/10.

#7. The Rolex Cosmograph Daytona is trending upward with a market average of $24,000 against a ~$24,000 (market value) retail — a 93.5% premium. This chronograph carries a flip potential score of 9/10.

#8. The Rolex Cosmograph Daytona is trending upward with a market average of $32,000 against a $16,550 retail — a 93.4% premium. This chronograph carries a flip potential score of 8/10.

#9. The Rolex GMT-Master II is trending upward with a market average of $18,000 against a ~$18,000 (market value) retail — a 85.6% premium. This gmt / travel watch carries a flip potential score of 9/10.

#10. The Rolex Cosmograph Daytona is trending upward with a market average of $30,000 against a $16,550 retail — a 81.3% premium. This chronograph carries a flip potential score of 8/10.

#11. The Rolex Cosmograph Daytona is trending upward with a market average of $71,640 against a $39,800 retail — a 80.0% premium. This chronograph carries a flip potential score of 8/10.

#12. The Rolex Cosmograph Daytona is trending upward with a market average of $61,470 against a $34,150 retail — a 80.0% premium. This chronograph carries a flip potential score of 8/10.

#13. The Rolex Cosmograph Daytona is trending upward with a market average of $71,640 against a $39,800 retail — a 80.0% premium. This chronograph carries a flip potential score of 8/10.

#14. The Rolex Cosmograph Daytona is trending upward with a market average of $36,090 against a $20,050 retail — a 80.0% premium. This chronograph carries a flip potential score of 8/10.

#15. The Rolex Submariner is trending upward with a market average of $14,000 against a ~$14,000 (market value) retail — a 72.8% premium. This dive watch carries a flip potential score of 9/10.

#16. The Rolex GMT-Master II is trending upward with a market average of $20,500 against a $12,350 retail — a 66.0% premium. This gmt / travel watch carries a flip potential score of 8/10.

#17. The Rolex GMT-Master II is trending upward with a market average of $15,000 against a ~$15,000 (market value) retail — a 62.2% premium. This gmt / travel watch carries a flip potential score of 9/10.

#18. The Rolex Sea-Dweller is trending upward with a market average of $18,000 against a ~$18,000 (market value) retail — a 58.6% premium. This dive watch carries a flip potential score of 9/10.

#19. The Rolex Submariner Date is trending upward with a market average of $14,500 against a ~$14,500 (market value) retail — a 58.5% premium. This dive watch carries a flip potential score of 9/10.

Frequently Asked Questions

Which watches are going up in value in 2026?

Our data shows 20 watches with upward price trends. The Tudor Submariner leads with a 1311.8% market premium.

Should I buy a watch that's increasing in value?

Watches with upward momentum can be strong investments, but past trends don't guarantee future performance. Consider factors like production volume, brand strategy, and your personal enjoyment of the watch.

More Insights

Watches with the Best Value Retention in 2026

Discover which luxury watches are trading highest above retail — a data-driven look at the best value retention in 2026.

Most Overpriced Luxury Watches in 2026

Data reveals which luxury watches carry the highest markups above retail — know what you're paying before you buy.

Best Watch Deals Right Now

Find luxury watches trading below retail price — the best deals on Rolex, Tudor, and Omega in 2026.